Stochastic models are the most advanced generation of demand forecasting algorithms. Using such models has only become feasible in recent times, since 2015, with the rapid growth of more powerful computers.

To describe probabilistic models, it is best to draw an analogy with classical methods for forecasting demand, such as the Holts-Winters method, Simple Moving Average, Exponential Smoothing, etc. Unlike these models, instead of a single number forecast, the algorithm produces a range of probabilities: 10 thousand units will be sold with a probability of 5%, 15 thousand units with a probability of 10% and so on. The end result is a complete picture of the range of demand.

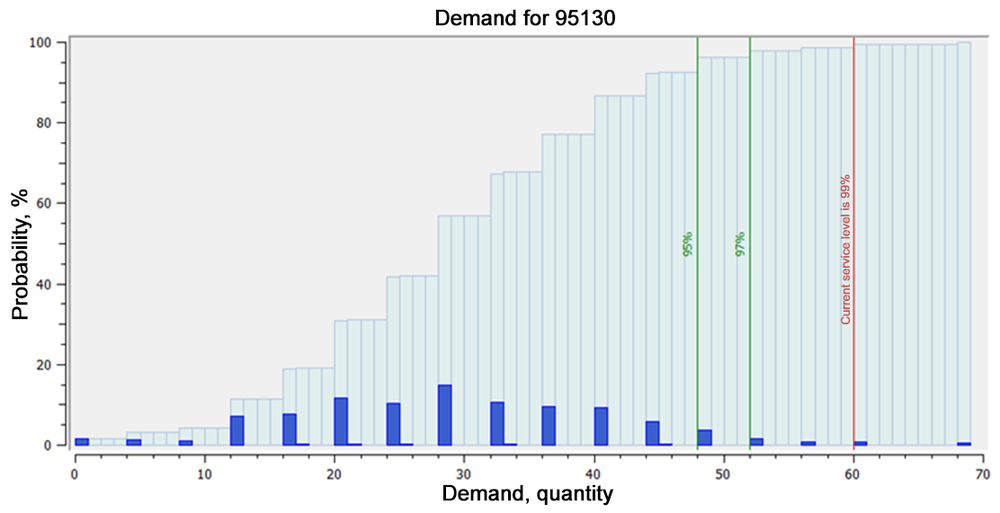

The figure below shows the probability magnitude of certain demand levels for item 95130 in dark blue.

Probabilistic models are based on mathematical modeling of the demand process itself and the likelihood of certain demand levels in the forecast period, making them a breakthrough compared to the classic methods, which were designed to tackle general problems from mathematics and statistics.

The mathematical model, using historical data, builds such a demand distribution for each item from each regional depot or store. In practice, the resulting distribution is almost never a normal distribution, which is usually used to calculate the safety stock in classic models.

Partial probabilistic forecasting

The use of partially probabilistic methods became possible in 2015. "Partial" here means that any probabilities less than <1% are ignored by the model. This was a factor of performance limitations of servers and desktop PCs. Even so, this approach is a more powerful one for dealing with demand. Service levels can be independently managed - i .e. you can find the optimal balance between how much demand there is and how many units you need in stock at each moment in order to maximize profits. This obviates the whole concept behind safety stock.

How does the model work in practice?

Suppose you want to forecast demand for 10,000,000 SKUs. We have a mathematical model that can forecast demand based on sales history. Based on demand parameters, a mathematical model is created that describes the demand profile. For example, the likelihood of various demand levels, probability of no demand over several days, weeks, or months. The model then makes between 500,000 and 1 million forecasts for each item, modeling possible outcomes of potential future events. In the end, depending on the frequency of a particular demand volume in simulated cases, we end up with a range of probabilities

- There is a 20% probability that 15 units will be sold.

- There is a 40% probability that 17 units will be sold.

- There is a 30% probability that 25 units will be sold.

- There is a 10% probability that 30 units will be sold.

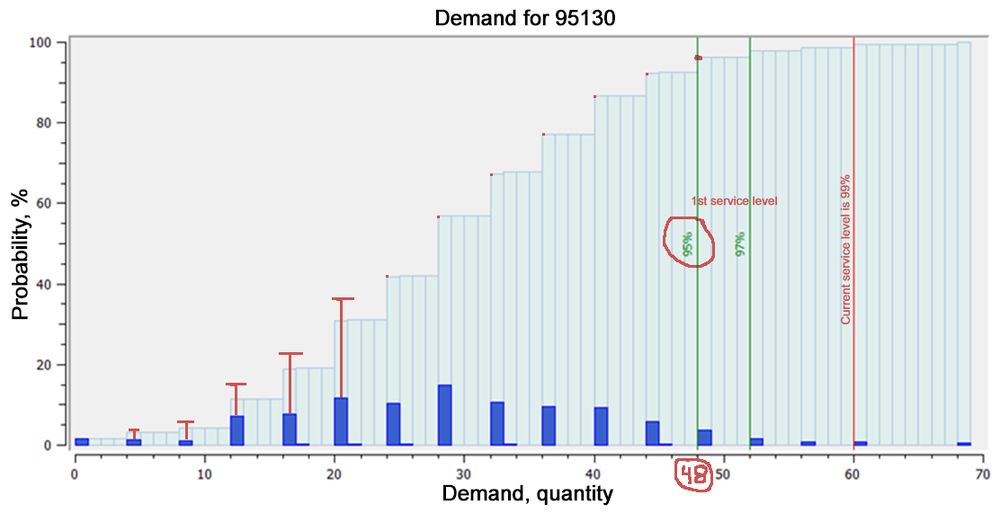

Now there is no need to separately calculate the safety stock. Instead, the optimal stock can be used based on the desired service level. The figure below shows the probability of occurrence of demand volumes in dark blue. If we're looking to provide a top-in-class service level of 95%, we need to find the number where 95% of all possible demand levels fall. The graph below shows that this point corresponds to 49 units. In other words, this the exact amount needed on hand for this particular period of time.

Partially probabilistic forecasting already allows us to move on to worry about risks, with the aid of knowledge of the likelihood of certain demand levels. If we know these probabilities and numbers, we can already estimate returns on invetory: which commodity items are profitable to store, where is it profitable to satisfy demand, and where are we going to end up with more loss than profit. This is where financial risk modeling comes into play.

Full probabilistic forecasting

In 2018, full-probability models broke onto the scene. These models are able to account for even the smallest probability of distribution, as low as 0.01% - which can be very significant when you're dealing with large volumes. Therefore these low probabilities are ignored at the business's own peril.

A key advantage of full probability methods is the ability to obtain a probability forecast of not only future demand, but other variables as well. You can forecast, for example, warehouse inventory levels on hand at the time orders are received. The classic methods use a point forecast for this. For example, you may use average sales to forecast the inventory of particular goods on some future date. This approach, however, completely ignores risks such as late deliveries on shipments from suppliers, potential peak events, and demand cycles.

Probability forecast can also account for delaying events such as stock-outs and shortages, effectiveness of promotions, and others. The more values where uncertainty is present can be estimated using a probability distribution, the more accurately and efficiently inventory and risk can be managed.

The next stage in the development of full-probability models is modeling of the entire supply chain from the distribution center to stores or end consumers. In this case, the probability distribution of delivery times between all links in the, probability of stock on hand at the time of delivery, probability of delivery failures. and other factors are taken into account. In contrast to the usual approach of disaggregated sales histories, end-to-end modeling makes it possible to account for lead times and shifts in planning horizons due to warehouse distance, and starting and forecast inventory levels of branches without needing to simplify (aggregate all inventories), which is a less than optimal solution.

Financial risk model

Another advantage of probabilistic methods is their power when combined with a financial risk model. This model allows the user to understand what amount of inventory is cost-effective to keep on hand in warehouses. Is it profitable to maintain a service level of 95% for a particular item, or will holdings costs be higher than sales? If the probability of sales is very small and there is a risk that the money will be tied up in stock, should we order or take a risk and not invest in purchasing inventory?

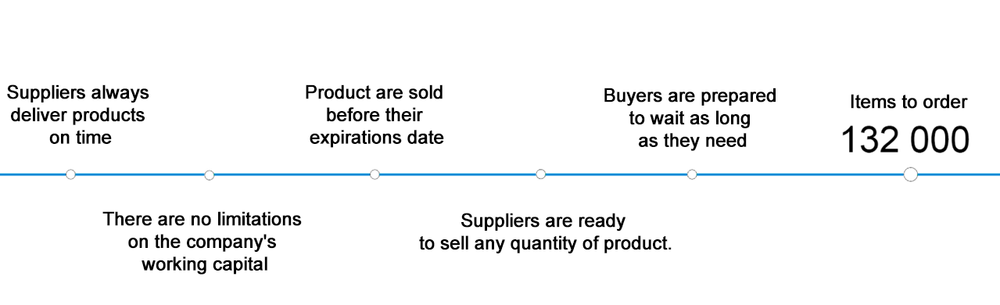

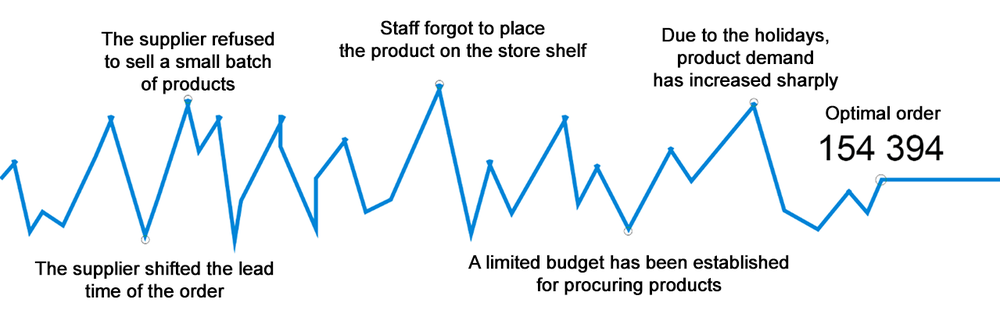

The future is unpredictable; therefore, demand cannot be predicted without taking risks into account, although this is what the classic models do. A classic method model might look something like this:

In reality, businesses face the problem that many risk events exist for different types of products. Taken as a whole these risks can have a profound effect on the optimum stocking level.

Risk-adjusted probability models can forecast a number of possible future events and outcomes, while accounting for potential risks. Ultimately, the use of such a model will determine the optimal inventory for each item so that the company can improve its bottom line.